The Asia Pacific region is projected to be the fastest-growing market for fats & oils. The region is home to two important palm and palm kernel oil-producing countries namely Malaysia, and Indonesia: and two major fats & oils consuming countries namely China, and India.

The global

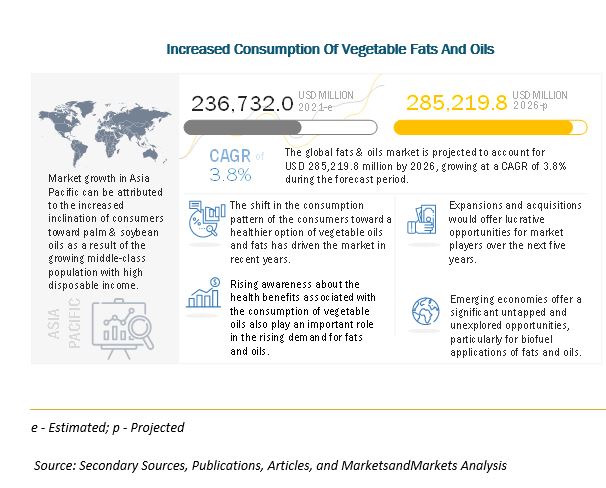

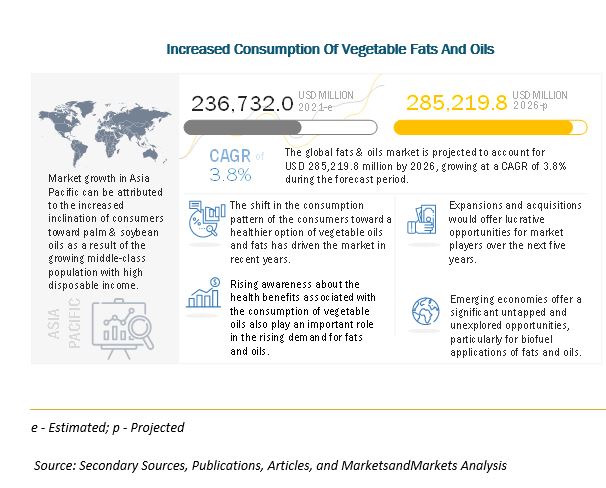

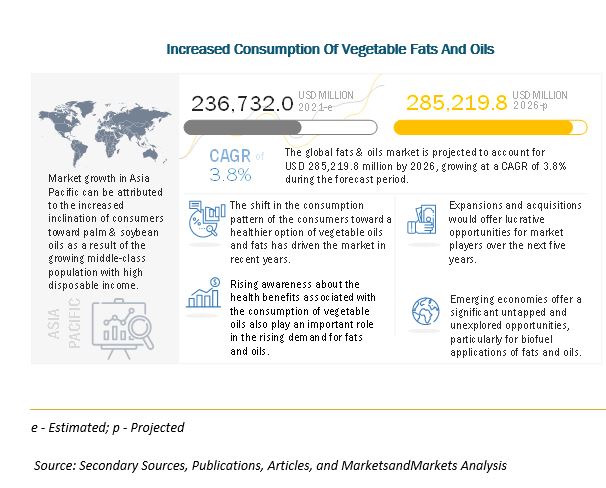

fats and oils market is estimated to be USD 236.7 billion in 2021; it is projected to grow at a CAGR of 3.8% to reach USD 285.2 billion by 2026. The global fats oils market is being highly driven by robust demand dynamics emanating from both the food and non-food application sectors. Although country-level dietary guidelines advocate a switch to unsaturated fats, the sales of butter and all the other vegetable oils are witnessing decent growth because they are perceived as being more natural. The fats oils market is also driven by non-food utilization, particularly for the production of oleochemicals and biofuels. Mandatory blending targets of biofuels have encouraged the uptake of these commercially important lipid compounds in the Western markets, which were soon adopted by developing countries.

The fats and oils market is dominated by few globally established players such as Associated British Foods PLC (UK), ADM (US), Bunge Limited (US), Wilmar International Limited (Singapore), United Plantations Berhad (Malaysia), Unilever PLC (UK), Ajinomoto Co., Inc. (Japan), Mewah International Inc. (Singapore), and Cargill, Incorporated (US). These players have adopted growth strategies such as agreements, joint ventures, and agreements to increase their presence in the global market.

Associated British Foods PLC (ABF), company is engaged in the processing and manufacturing of food, ingredients, and retail. It operates through five business segments, namely sugar, agriculture, retail, grocery, and ingredients. ABF operates through various subsidiaries, some of which are AB Agri (UK), AB Mauri (UK), ABF Ingredients (UK), ABITEC Corporation (US), AB Enzyme GmBH (Germany), ACH Food and Companies Inc. (US). Amongst all its subsidiaries, ACH Food Companies Inc. (U.S.) produces fats and oils products. ACH Food Companies Inc. (U.S.) was formerly known as AC Humko Corporation. After being acquired by ABF from Kraft Foods (U.S.) in 1995, the company is engaged in the manufacture and distribution of a variety of cooking oils, such as corn oil, canola oil, olive oil, and other food ingredients, which include corn starch, syrup, spices, and sauces. In 2002, ABF acquired Unilever PLC’s (U.K.) Mazola, Henri’s and Golden Griddle brands, which are now managed by ACH Food Companies. Its fat and oil products are traded under the Mazola brand, which includes a wide range of products, such as corn oil, canola oil, olive oil, and few others.

Archer Daniels Midland Company (ADM) is primarily engaged in food processing and commodities trading. It is one of the key players in the agricultural processing and food ingredient providing sector. The company operates through four major segments, namely Ag services oilseeds, carbohydrate solutions, nutrition, and other business. The company offers oils derived from vegetable sources for food, industrial, and fuel applications. The company operates globally in more than 140 countries through 272 processing plants and more than 470 crop procurement facilities, where cereal grains and oilseeds are processed into products used in the food, beverage, nutraceutical, industrial, and animal feed markets. The company operates its business through several subsidiaries, such as Golden Peanut Company LLC (U.S.), ADM Milling (U.S.), ADM do Brazil Ltd a (Brazil), Wild Flavors, Inc. (U.S.), and ADM Hamburg AG (Germany).

Bunge Limited provides integrated operations in the agribusiness and food segments globally. The company crushes and processes oilseeds and grains that include wheat, corn, and sugarcane for food processors, bakeries, breweries, and other commercial customers. The company has four main business segments, namely agribusiness, sugar and bioenergy, food ingredients, and fertilizers. Bunge offers bulk oils, shortenings, margarine, mayonnaise, and other products derived from vegetable oils under the food and ingredients business segment. The company has its presence in almost 40 countries in the Asia Pacific, African, Middle Eastern, European, Caribbean, Central American, North American, and South American regions. Its subsidiaries, such as Bunge North America, Bunge South America, Bunge Asia Pacific, and Bunge Europe, are engaged in oilseed processing, edible oils refining packaging, shortenings, and corn dry milling.

Asia Pacific, followed by Europe, accounted for the largest share both in value and volume in the global fats oils market in 2021. The large consumption base in Asia Pacific, i.e., robust processed foods and industrial applications for fats and oils, makes it the fastest-growing region during the forecast period. Asia pacific fats oils market is majorly driven by China and India, owing to the shift in consumption patterns and the high imports of vegetable oils and fats. As per a report by Jiangnan University, China, the consumption of vegetable oils in China has been increasing year by year. The top vegetable oils consumed in China included soybean oil, rapeseed oils, palm oil, and peanut oil. India is the world’s second-largest consumer and the largest importer of vegetable oils. The country is expected to maintain a high per capita consumption level, reaching 14 kg/capita by 2030.